Photo of venture capitalist Kevin O’Leary of tv show Shark Tank from AndPhilosophy.com.

Every day, you wake up earlier than you’d like, stumble to the bathroom and take care of your hygiene routine. You might pop a frozen breakfast sandwich in the microwave or have a quick cup of coffee. Then, you’re out the door and in your car or standing on the corner for a bus. You do all of this in the pursuit of money. But what if all the money you ever wanted was in one place and all you had to do was buy it?

Why You Should Buy Money

The concept of buying money might seem comical until you think of the money debt collectors have bought related to your old delinquent credit accounts. Say for instance you buy an expensive radio on credit. You get it home, and it breaks a few months later, but the retailer or manufacturer won’t refund you. So, you buy another radio and stop making payments on the previous one. At some point, the finance company will sell your debt to debt collectors for pennies on the dollar. So, for every dollar you owe, the debt collector will pay the original debt holder about 4 cents on every dollar. If you owe $40, the debt collector will pay the finance company $1.60 in total.

You too can “buy” money without being a debt collector.

Imagine if this transaction had happened in realtime live with physical money. You would see the finance company hand over $40 to the debt collector, as the debt collector hands over $1.60 to the finance company. This is an act of “buying” money or buying debt. The obvious risk is, there is no guarantee the debt collector will be successful in collecting the debt. In that case, the debt collector loses $1.60, and the finance company gains $1.60 which is a loss but not a complete loss. You too can “buy” money without being a debt collector.

Fear the Stock Market

The stock market is a scary place, scattered with the unforgotten bones of the Great Recession and Great Depression. If any American thinks of it, Bernie Madoff, Enron and other financial travesties come to mind. To the average American, this means steer clear. To others, it’s the perfect playground to “buy” a dollar for ten to fifty cents.

Let me explain the concept more clearly. Say for instance you buy one share of Applied Digital stock for $4 and sell it for $20. For every 20 cents you spent, you got 80 cents in return. In a roundabout way, you bought a dollar for 20 cents, sold it for 100 cents and netted an 80 percent profit. But profit isn’t guaranteed, and that is where the fear comes in.

The inexperienced trader will run from the stock when it is low in price and buy it when it is high…

In reality, all stock prices rise and fall, so the point is to buy low and sell high. For example, if the stock of a company is trading at $8 in June and $40 in October, the best time to buy it is in June. The inexperienced trader will run from the stock when it is low in price and buy it when it is high, losing the profit in between.

Taking this example a step further, if you buy the stock in June for $8 a share and sell it at $40 a share in October, you will make a $32 net profit on each share. The inexperienced investor who buys it at $38 and sells it at $40 will make a measly $2 profit. Going back to the concept of buying low and selling high, it will determine if you make a profit. You must first break your natural habit to flee in times of distress.

Buying in the Red

When the price of stock is falling, the experienced trader is buying, while the inexperienced trader is selling or running. When you look at the red stock chart of any company, your stomach turns. The thought of buying it is like buying a pile of trash that probably one day maybe might be worth something. The feeling is known well. Overcoming it is a conscious process.

But red can be good in the stock market.

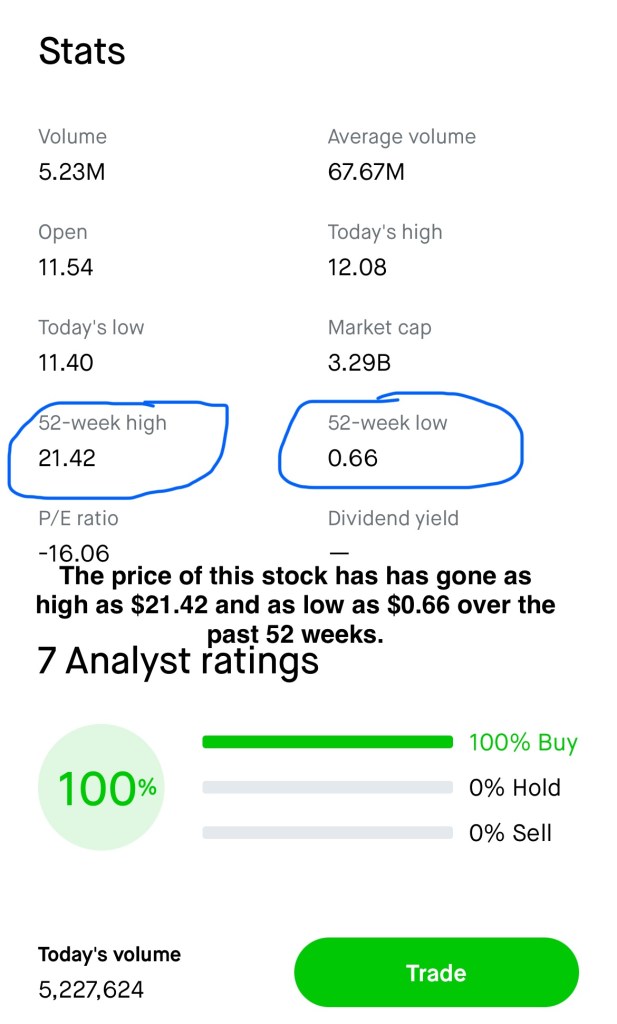

We are taught to associate the color red with danger. But red can be good in the stock market. Before buying stock in the red or on the decline, look at its 52-week chart. Is the price higher or lower year-over-year? If it is, it might be worth buying. You also have to look at its 52-week high and 52-week low. If its 52-week high is $40 and its 52-week low is $12, buying it at $14 — 30 would be a worthwhile investment, especially if you get in on the lower end.

Buying in the red or when the price of a company’s stock is low makes your chances of profit more likely. It also increases your net profit with larger gains.

Stocks and Options

I learned about the stock market in detail as a teenager enrolled in a business competition at a Chicago nonprofit organization. I learned about trading stock, but I did not learn much about stock options. When I first started trading stock options, I took thousands of dollars in losses. Traders call that paying the stock market tuition. Even though the concept of trading stocks and options might seem remote, it’s in the palm of your hands.

When you buy stock in a company, one share equals one share. A stock option is a bundle of 100 shares of stock. So, when you buy a stock option of Nike, you’re renting 100 shares of stock. Whether or not you make a profit will depend on the strike price you choose and the price you pay for the stock option. This is a brief overview, and there is a lot more to trading options which includes picking a stock with a good expiration date. Still, with stock options, the idea of buying low and selling high remains the same.

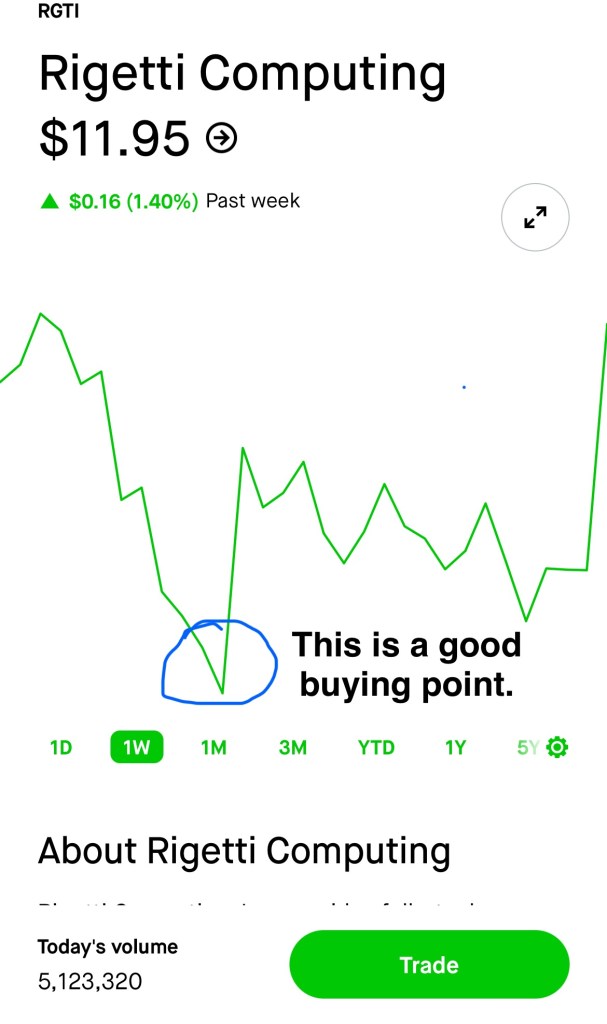

Rigetti Computing was trading at 66 cents and is now trading at over $11 per share. That’s a 94 percent net profit for a trader. The trader who got in early got over 16 times their investment back. It’s like buying a dollar for 6 cents. This stock still has room to climb, considering it peaked in December of 2024 and might again. In the below screenshot from the RobinHood brokerage app, you’ll notice a big dip in Rigetti’s stock price, and this is a great point to buy.

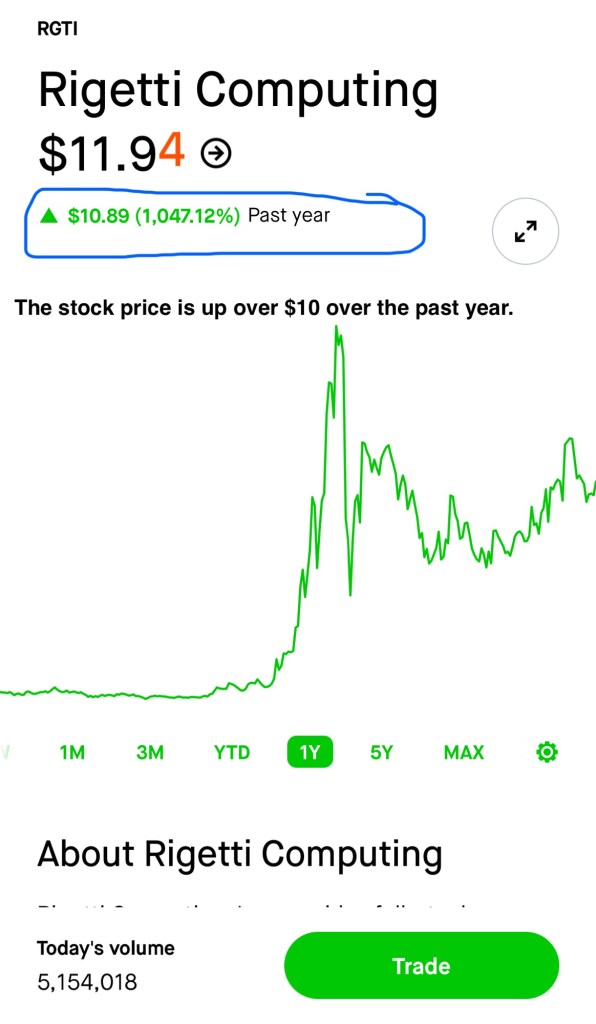

If you have doubts about buying the stock of a company, look at the one-year chart. Looking at Rigetti Computing’s, you’ll see that it is up $10.89 over the past year, and that represents an over-1,000-percent increase.

Traders buy stock options because they can be more profitable than just stock. For instance, you can buy an AMC stock option for $5 and sell it for $28 or more. That might not seem significant, but if you invested $500 in this stock option, you would make a profit of $2,800, with a net profit of $2,300. For every one dollar you spend, you would make 80 cents. That’s an 80 percent profit.

Also, the stock option makes more money, considering one share of AMC costs less than $3, and 80 percent of $3 is $2.40. Assuming the AMC stock price rose 80 percent from $3 to $5.40, it would bring only a $2.40 profit. You would be better off buying the AMC option than the stock itself. As with all stock options, the price of any AMC option will depend on the price of the stock and other factors.

You can double, triple or quadruple your money investing in stock alone.

You can double, triple or quadruple your money investing in stock alone. Take as an example Hims and Hers, the sexual health company. Earlier in the year, it was trading at just under $26 a share. Currently, it is trading at over $50 a share and looks to go to at least $80 a share by the end of February 2026. Traders who got in early will likely see a profit that’s over three times greater, a $54 profit per share, than their initial investment. Those who invest now will see a profit of about 40 percent or $30 a share.

The past performance of a stock does not mean it will perform that way again in the same timeframe, but it’s a good indicator. Many retail apparel companies tend to see peaks in August or September due to kids returning to school. They also see peaks around October, December, January and February, all months with major holidays. So, if you know the industry, you know when certain companies will perform the best and the worst. You buy when it’s doing badly and sell when it’s doing well. By all means, when Rigetti was trading at less than 70 cents, it was doing badly. Now, it’s doing very well on price. And Rigetti Computing isn’t a unicorn. There are many companies I’m invested in experiencing similar growth in their stock prices.

The Complexity

Trading stocks and options is not hard, but it requires time, attention and good decision making. I know for many who read this article, this will seem like an information dump, and it might be to a degree. For me to explain every detail of trading would take a book, one that I’m actually writing. So, if you would like to know more about trading, look for my upcoming book Investing Explained Step-by-Step: For the Young, Old and Bold. It lays out in detail how to trade stock and options for the beginner or experienced. It is designed to be completed in six weeks, and it includes real examples with activities to get you involved in the stock market.

The Takeaway

You trade ten to twelve hours of your life five to seven days of the week in a pursuit to pay your bills, support your family and enjoy life. The more you work, the more money you make. You might even take a second job. But you don’t have to. Although trading stock may seem like a remote and confusing idea, you have a cellphone and, thereby, the means to trade stock and become financially independent of an employer. You can double or quadruple your money. We buy many things — cars, jewelry and clothes — that don’t gain value. $5 at the gas station is one gallon of gas and maybe a stick of gum. $5 in the stock market can be bring back over five times as much or more. Look for my Investing Explained Step-by-Step: For the Young, Old and Bold book that goes into stock trading in detail. It’ll free you from the chains of the employer you work for and that pesky coworker.

This article was written by Jermaine Reed, MFA, the Editor-in-Chief of The Reeders Block. Join the email list to get notifications on new blog posts and books. This article is 100% human-written. And remember, if you see an error, that’s what makes us human.

Discover more from The Reeders Block

Subscribe to get the latest posts sent to your email.

One thought on “Where is the Money?”